Florida Foreclosures Rates Highest in The Nation Amidst Decline

Foreclosure activity in the US is at it’s lowest levels since 2006 which is great news for most markets. Overall foreclosure filings are down 14% month over month and 23% year over year to date which makes for a 6 1/2 year low. Unfortunately, even with the decline Florida’s foreclosure rates are the highest in the nation despite a 23% decrease compared to 2012.

Foreclosure activity in the US is at it’s lowest levels since 2006 which is great news for most markets. Overall foreclosure filings are down 14% month over month and 23% year over year to date which makes for a 6 1/2 year low. Unfortunately, even with the decline Florida’s foreclosure rates are the highest in the nation despite a 23% decrease compared to 2012.

The Florida foreclosure rate is at 1.74% which equates to 1 in every 58 homes, for a total of 155,264 filings so far this year. Along with having the highest foreclosure rate in the nation when comparing metropolitan area foreclosures Florida housed the top 5. The worst foreclosure area’s were Miami (2.4%), Orlando (1.9%), Jacksonville (1.9%), Ocala (1.8%), and Tampa (1.7%).

If you’re facing foreclosure like many homeowner’s in the state of Florida or anywhere else in the U.S. we can help! Visit our homepage and put in your zip code to get started.

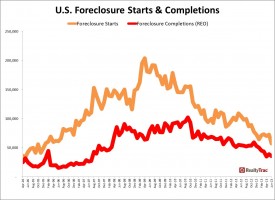

Below you can find national foreclosure statistics for June 2013 provided by Realty Trac a leader in real estate data :

Foreclosure Starts vs Completions

- Starts – Down 21% month over month and 45% year over year to date

- Total Foreclosure Starts – 409,491

- Projected Foreclosure Starts – 800,000+

- Completions – Down 9% month over month and 35% year over year to date

- Total Foreclosure Completions – 248,538

- Projected Completions 2013 – 500,000

Judicial Foreclosure Auctions

On the contrary to starts and completions foreclosure auctions are spiking, and you guessed it Florida once again is at the top along with New Jersey and Maryland. All three had foreclosure auction increases of 100%, 104% and 94% respectively. This spike is due to the overwhelming foreclosure numbers in recent years causing a large backlog of properties that are just now reaching the auction stage.

For more information on foreclosure statistics check out the video below.